The PA Department of Community & Economic Development (DCED) opened a new round of Enterprise Zone (EZ) Program Tax Credits through its Neighborhood Assistance Program (NAP). City of Bethlehem companies in eligible sectors can receive qualified project investments.

Once approved, and the investment completed, the company is eligible for up to a 25% tax credit, with a maximum of $500,000 in credits for the project.

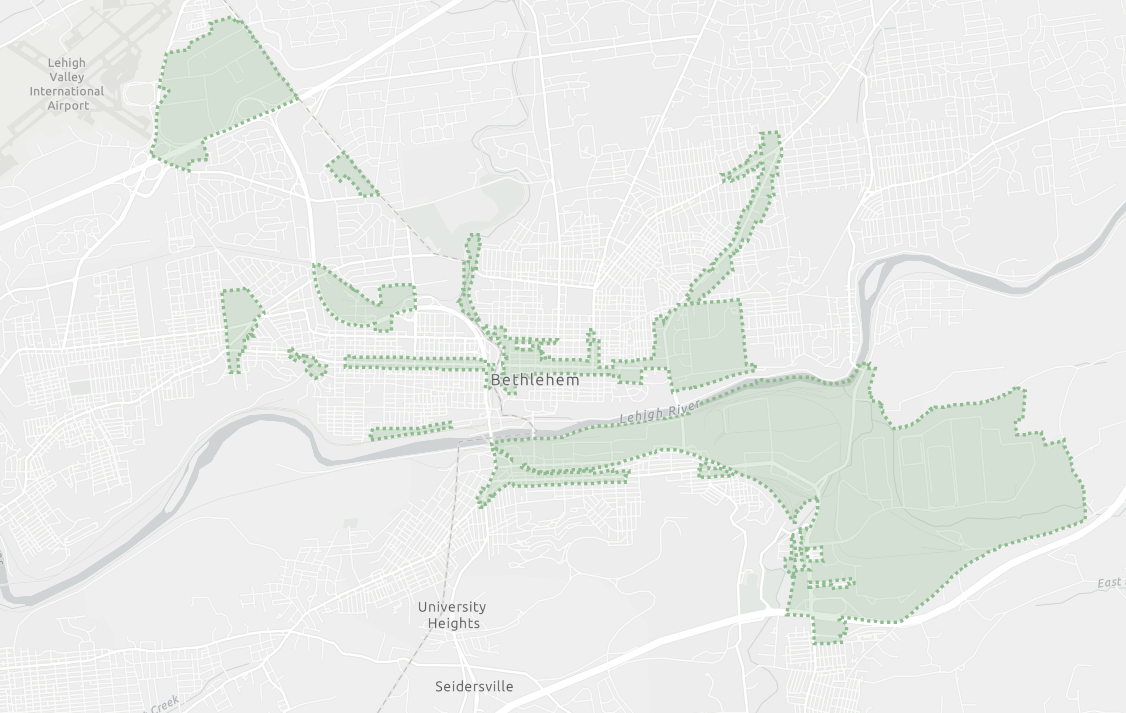

Eligible Applicants: Private, for-profit businesses with emphasis on agricultural, industrial, manufacturing, or research and development companies located within the City’s Enterprise Zone, noted in the map below.

Eligible Activities: Rehabilitation, expansion, improvement to a building(s), improvement to land, engineering, architecture, acquisition. Accompanying investment must be incurred, and the approved project completed, between July 1

st, 2025 – September 30

th, 2026.

Review PA DCED's updated program guidelines

here.

*Employment opportunities must be created for low-income individuals located within the designated zones. Employment opportunities must be full-time, higher than state minimum wage at a family sustainable wage and include benefits.

Over $5.5 million in EZ Tax Credits have been awarded to 22 projects in the City of Bethlehem since 2015.

To learn more about the program, confirm your eligibility, and discuss your company’s project,

email Alex.